The Curves Group regards the enhancement of a highly effective corporate governance as an important management concern in order to achieve sustainable growth and improve corporate values over the medium to long term. We establish a system and are implementing various measures based on the basic policy of corporate governance to maintain transparency and soundness of management, to respond to fast changing business environments, and to realize timely decision-making and flexible organization management. We will continue to build a highly transparent business management system by enhancing and strengthening the corporate governance.

Current status of corporate governance system

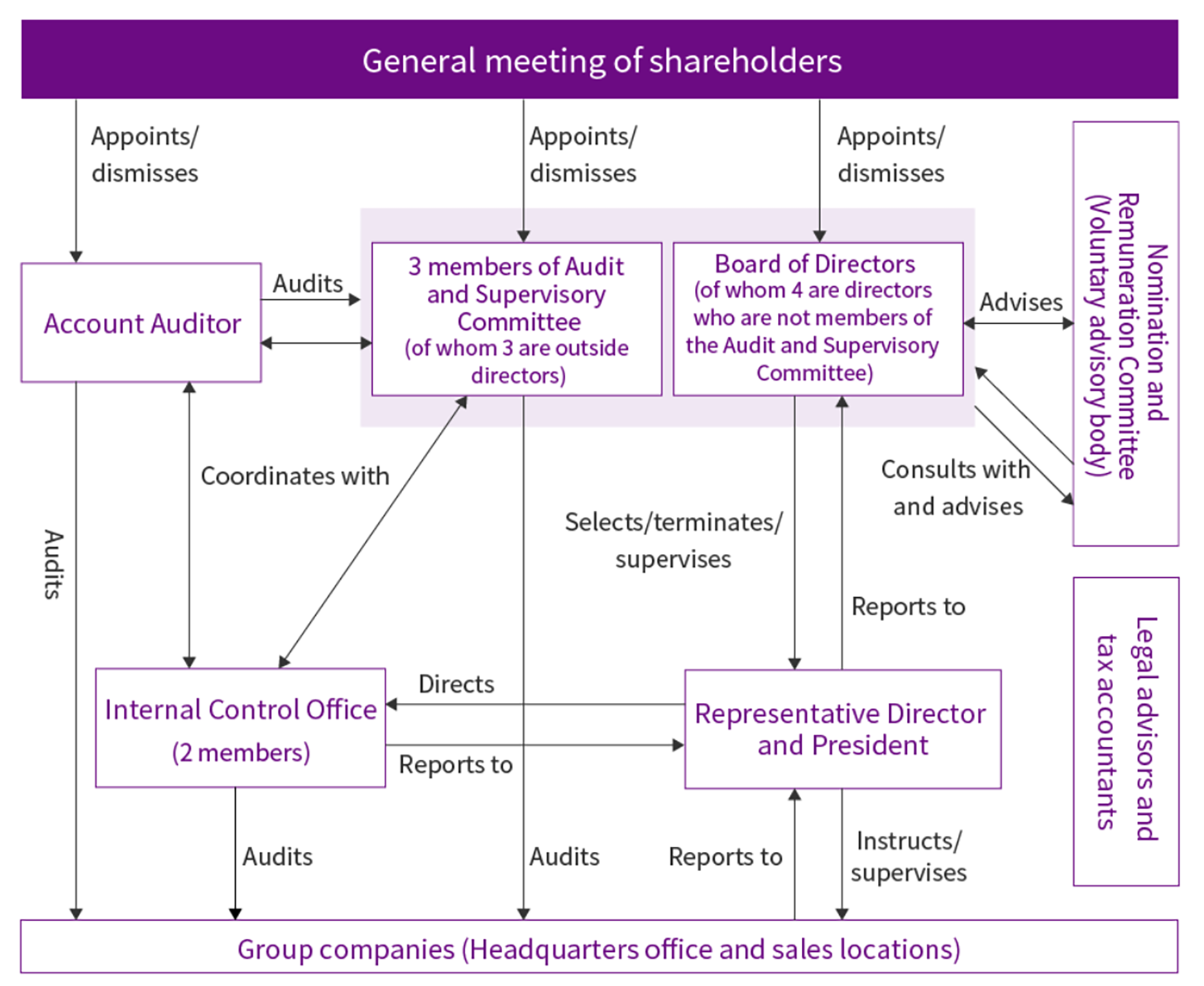

- The Group's governance adopts a management system in which all subsidiaries are responsible for business execution functions by devoting themselves to business promotion, while the Board of Directors of the Company as the holding company is responsible for the management and supervisory functions of the entire Group.

- The Company's board of Directors consists of seven directors. Regular meetings are held once a month, and special board meetings are held as needed. It makes decisions on management policies, management plans, annual budgets, and other material matters for each Group company. It also approves reports on monthly budget control, monthly business reports, and other important business matters from each Group company, and supervises business execution through active Q&A and discussions.

- The Company’s Directors (excluding Directors as Audit and Supervisory Committee members) concurrently serve as directors of each Group company and directly supervise the business execution of each company. We have put in place a system that enables flexible and prompt decision-making by coordinating place and time of the board meetings. The term of office of Directors (excluding directors as Audit and Supervisory Committee members) is set at one year in order to strengthen corporate governance.

- All three Directors as members of the Company's Audit and Supervisory Committee are outside directors, one full-time and two part-time, all forming the Audit and Supervisory Committee.

Composition of the Board of Directors

[Directors (excluding Directors as Audit and Supervisory Committee members)]

| Name | Position | Reason for nomination as a candidate for Director |

|---|---|---|

| Takeshi Masumoto | Representative Director, President and Group CEO | Mr. Takeshi Masumoto founded Curve Japan Co., Ltd. in 2005 and assumed the position of Representative Director. In 2011, he became Representative Director of the Company. His strong leadership and effective and prompt management decisions based on foresight have contributed to the continued growth of the Group since then, such as the acquisition of Curves’ global headquarters and European franchise headquarters, the listing on the First Section (then) of the Tokyo Stock Exchange through the spin-off of KOSHIDAKA HOLDINGS Co., LTD., the planning and execution of new strategies in domestic and overseas businesses, the creation and expansion of new businesses, and the development of new products. Recognizing him as an essential leader for the continued development of the Group, he has been appointed as a Director. |

| Maki Sakamoto | Director | Mr. Maki Sakamoto is a founding member of the Group who joined Curves Japan Co., Ltd., a core company of the Group, in 2005 and has served in many positions such as President and COO of Curves Japan. Currently, he demonstrates leadership as Representative Director and President of Curves Japan mainly in such areas as legal affairs and risk management of the Group, facility network expansion, marketing, strengthening distribution network, and new business development, and is in charge of formulation and execution of strategies. He has contributed to the development of the Group as a whole. Leveraging his wealth of experience and in-depth knowledge, he has been appointed as a Director, as he is expected to continue contributing to the Group's growth. |

| Yoko Masumoto | Director | Ms. Yoko Masumoto is a founding member of the Group who joined Curves Japan Co., Ltd., a core company of the Group, in 2005 and has served in many positions such as Vice President and General Manager of Business Development Division of Curves Japan. Currently, she demonstrates leadership as Representative Director and Vice President of Curves Japan mainly in such areas as chain management, human resources development, organizational management, know-how development, facility operations, and new business development. She has contributed to the development of the Group as a whole. Leveraging her wealth of experience and in-depth knowledge, she has been appointed as a Director, as she is expected to continue contributing to the Group's growth. |

| Shinya Matsuda | Director | Since assuming the position of General Manager of the Business Administration Department of the Company in 2011, Mr. Shinya Matsuda has supported the Group's management team as the head of the Group's administration division, leveraging his high level of expertise and extensive experience in accounting and finance operations. He has also promoted the strengthening of the management system for overseas subsidiaries. Utilizing his wealth of experience and achievements in accounting, finance, and corporate planning at listed companies over many years, he has been appointed as a Director, as he is expected to continue contributing to the development of the Group. |

[Directors as Audit and Supervisory Committee members]

| Name | Outside Director | Reason for nomination as a candidate for Outside Director and expected roles |

|---|---|---|

| Toyokazu Kawada | ○ | Mr. Toyokazu Kawada has extensive experience and achievements, including stock agency operations at financial institutions, as well as supporting DX transformation, IR activities, and ESG management for listed companies in the consulting industry. Based on the judgment that he possesses broad insight into management necessary for supervising the Company’s operations and can be expected to fairly and objectively oversee the appropriateness of the Company’s management while enhancing auditing functions, he has been appointed. |

| Sadayoshi Yamamoto | ○ | Mr. Sadayoshi Yamamoto has considerable knowledge about finance and accounting as a certified public accountant and abundant and extensive insight necessary for auditing the Company’s management from an objective standpoint. We have nominated him based on the judgment that he can be expected to fairly and objectively supervise the appropriateness of management for the management team to engage in business execution and enhance auditing functions as Audit and Supervisory Committee Member. |

| Masahide Teraishi | ○ | Mr. Masahide Teraishi has engaged in leading-edge research on corporate management as a university professor and has abundant and extensive insight necessary for auditing the Company’s management from an objective standpoint. We have nominated him based on the judgment that he can be expected to fairly and objectively supervise the appropriateness of management for the management team to engage in business execution and enhance auditing functions as Audit and Supervisory Committee Member. |

Please see the link below for the list of Directors.

List of Directors

Skill Matrix

Please see the link below for the abilities (skills, experience, and expertise) of our Directors and Directors as Audit and Supervisory Committee members.

Skill Matrix

Arbitrary Committee

The Company has established and operates an arbitrary Nomination and Remuneration Committee in order to ensure the fairness of the Board of Directors' objective judgments and procedures regarding the nomination and remuneration of Directors (excluding Directors as Audit and Supervisory Committee Members). The committee consists of one Representative Director and two independent outside Directors. Independent outside Directors make up the majority, and an outside Director serves as chairman of the committee, enhancing independence and objectivity.

As an advisory body to the Board of Directors, the Nomination and Remuneration Committee has the function of submitting matters for discussion to the Board of Directors. At the request of the Board of Directors, the committee deliberates on nomination and dismissal of Directors (excluding directors as Audit and Supervisory Committee members) and Representative Director, policies and methods of determining remuneration for Directors (excluding directors as Audit and Supervisory Committee members), and establishment, revision and abolition of Company’s material regulations related to nomination and remuneration.

Use of outside Directors for free and active discussions

The Company believes that the professional and objective perspectives and opinions of independent outside Directors are useful in the corporate governance. In selecting independent outside Directors, the Company does not have any stipulated criteria or policies regarding independence, but refers to the independence criteria stipulated by Financial Instruments Exchanges when judging independence. Further, in selecting outside Directors, in addition to the requirements of the Companies Act, we emphasize a wealth of experience and deep insight in corporate management and select those who meet the qualifications of independent Director stipulated by Financial Instruments Exchanges without fear of causing conflict of interests with public shareholders.

For free and active discussion, we provide outside Directors with materials such as internal information as appropriate, and we are working to ensure that they can fully demonstrate the functions of supervision and audit of appropriateness of the management. In addition, to ensure that outside Directors can fully supervise and audit the appropriateness of the management, outside Directors and Representative Director hold meetings to exchange opinions as appropriate.

Remuneration for Directors

Remuneration for Directors

The Company has established and operates an arbitrary Nomination and Remuneration Committee in order to ensure the fairness of the Board of Directors' objective judgments and procedures regarding the nomination and remuneration of Directors (excluding Directors as Audit and Supervisory Committee Members). The committee consists of one Representative Director and two independent outside Directors. Independent outside Directors make up the majority, and an outside Director serves as chairman of the committee, enhancing independence and objectivity.

Matters related to decision-making policy regarding the content of individual remuneration, etc. of member of the Board of Directors

The Company has established policies for determining the content of remuneration, etc. for individual Directors as outlined below. The method of determining the decision-making policy is based on a resolution of the Board of Directors.

(1) Basic policy

Remuneration for the Company's Directors (excluding Directors as members of the Audit and Supervisory Committee and outside Directors; hereinafter the same unless otherwise specified) is based on a combination of basic remuneration and non-monetary stock remuneration to make incentives work to ensure continuous growth of the corporate value. The basic policy is to determine total amount of remuneration of each director combining basic remuneration and stock remuneration by comprehensively considering the Director’s position, evaluation of the duty execution, company performance, etc.

(2) Contents, “numerical values” or “calculation method” of basic remuneration and non-monetary remuneration, etc. for individual directors

Based on the basic policy of (1), an amount equivalent to 90% of the total amount of remuneration determined by comprehensively considering the position and each Director’s performance, Company’s performance, etc. is paid as basic remuneration (monetary remuneration), and 10% as non-monetary remuneration in the form of the Company shares and a certain percentage of money in accordance with the Director Stock Benefit Regulations.

Basic remuneration (monetary remuneration) is paid within the remuneration limit determined at the General Shareholders’ Meeting.

(3) Policy regarding determination of timing and conditions for paying remuneration, etc.

Basic remuneration (monetary remuneration) is paid on a monthly basis during the term of office. For stock remuneration, points are granted on the day of the annual general shareholders’ meeting in each fiscal year, and the right to receive benefits is vested on the day three years after the points were granted or on the day of retirement. However, if the general shareholders’ meeting or the board of directors resolves to dismiss him/her, if he/she resigns due to certain misconduct during his/her tenure, or if he/she commits an inappropriate act that causes damage to the Company during his/her tenure, the right to receive benefits shall cease.

(4) Matters related to resolutions of general shareholders’ meetings regarding Director remuneration, etc.

The 11th Regular General Shareholders’ Meeting held on November 28, 2019, has resolved the amount of monetary remuneration for Directors (excluding Audit and Supervisory Committee members) shall be within 500 million yen per year (excluding salaries for employees). At the conclusion of General Shareholders’ Meeting the number of Directors is four.

The 11th Regular General Shareholders’ Meeting held on November 28, 2019 has resolved that the amount of monetary remuneration for Directors as Audit and Supervisory Committee members shall be within 40 million yen per year. At the conclusion of General Shareholders’ Meeting the number of Directors as Audit and Supervisory Committee members is three.

At the 13th Regular General Shareholders’ Meeting held on November 25, 2021, a resolution was passed to introduce a stock compensation plan for Directors.

(5) Matters concerning delegation to Directors and other third parties regarding the determination of the content of remuneration, etc.

-

Name of the person entrusted or position/responsibility in the Company:

President and Representative Director -

Details of authority to be delegated:

Proposing Individual total remuneration determined in (2) above -

Details of any measures for proper exercise of the authority

The Nomination and Remuneration Committee, an advisory body consisting of a majority of independent outside Directors, deliberates on remuneration levels, etc., and submits approved proposals to the Board of Directors after approval by the Audit and Supervisory Committee. The Board of Directors deliberates on the proposed proposals, and the Representative Director decides on the total amount of remuneration.

(6) Method of determining the content of remuneration, etc. (other than items in (5))

Not applicable

(7) Other important matters concerning the determination of the content of individual remuneration, etc.

Not applicable

Evaluation of effectiveness of the Board of Directors

From the fiscal year ended August 2021, the Company has been analyzing and evaluating the effectiveness the Board of Directors once a year with the aim of improving its functions. The method and summary of the evaluation of effectiveness of the Board of Directors for the fiscal year ended August 2025 are as follows.

Evaluation method

We conduct a questionnaire survey by all seven Directors of the Board of Directors to analyze and evaluate the effectiveness of the entire Board of Directors based on the opinions of external consultants.

Evaluation items

The primary items of the effectiveness evaluation questionnaire are as follows.

- Composition and operation of the Board of Directors

- Management strategy and business plan

- Risk management

- Nomination and compensation

- Dialogue with shareholders, etc.

Evaluation results

The Group has confirmed that the Board of Directors of the Company is generally operated appropriately and its effectiveness is ensured.

While overall evaluation has improved compared to the previous year, it has also been confirmed that further efforts are necessary to address areas such as the identification and oversight of key risks, discussion of corporate culture, and deliberations from a stakeholder perspective.

Internal control system

The Board of Directors meeting on November 28, 2019 has resolved a basic policy for developing the internal control system with the aim to build a "system to ensure the appropriateness of operations" as stipulated in the Companies Act and the Ordinance for Enforcement of the Companies Act.

Basic Policy for Establishing the Internal Control System

(1) System to ensure that the execution of duties by Directors and employees of the Company and its subsidiaries (hereinafter referred to as “the Group”) conforms to the laws and regulations and the Articles of Incorporation

- We establish a code of conduct for the officers and employees of the Group to comply with the laws and regulations and the Articles of Incorporation, and to respect social norms and ethics in the execution of their duties, which we ensure is fully implemented.

- The Company's Internal Control Office continuously audits the operating status of the internal control system based on the "Internal Control Regulations" and reports the results to the Directors and the Audit and Supervisory Committee as appropriate.

- The Company makes use of the internal reporting system to detect and prevent violations of the regulations at an early stage, and takes prompt action when correction or improvement is necessary.

(2) System for storing and managing information related to the execution of duties by Directors of the Company

- Information related to the execution of duties by Directors, including the proceedings and materials of important meetings such as General shareholders’ Meetings and Board of Directors meetings is prepared, stored and kept in writing or electronically in accordance with laws and regulations and various regulations such as "Document Management Regulations".

- Information relating to the execution of duties by Directors is maintained in a manner in which any related parties can view and copy it as needed.

- We strive to disclose information related to the execution of duties by Directors in accordance with laws and regulations or the Tokyo Stock Exchange's "Regulations Concerning Timely Disclosure of Corporate Information by Issuers of Listed Securities."

(3) Regulations and other systems for managing the risk of loss of the Group

- We establish “Risk Management Regulations” to deal with all risks of loss to the operations of the Group, and we implement a system to identify expected risks, to take preventive measures, and to minimize damage in the event of risks occurring.

- Management Administration Department is responsible for risk management of the Group. When the Group becomes aware of the occurrence of a risk, it is promptly reported to the Representative Director or the Board of Directors through the Management Administration Department and Risk Countermeasures Committee is formed as instructed, whereby we strive to prevent the spread of damage through prompt response.

(4) System to ensure efficient execution of duties by Directors of the Group

- The Company has established "Affiliated Company Management Regulations" and defined the management system to clarify the separation of management decision-making and business execution, to expedite decision-making, and to clarify administrative authority and responsibilities. The Group companies adopt an executive officer system and executes business in accordance with various regulations such as the "Regulations of the Board of Directors".

- We require our subsidiaries to hold regular meetings of the board of directors, management meetings, and other meetings as necessary, and to develop "organizational management regulations" and "rules for segregation of duties" according to their scale.

(5) System to ensure the appropriateness of operations in the Group consisting of the Company and its subsidiaries

-

1) System for reporting to the Company on the matters related to the execution of duties by directors, etc. of our subsidiaries

- The Company sends executives and employees to its subsidiaries, who execute, monitor, supervise, or audit the subsidiary's business in accordance with their assigned duties, and report to the Company's Directors.

-

2) Regulations and other systems for managing the risk of loss of our subsidiaries

- The subsidiaries conduct risk management based on the Company's "Risk Management Regulations", identify anticipated risks, take preventive measures, and promptly report to the Management Administration Department in charge of risk management of the Group if any risk is identified.

-

3) System for Efficient Execution of Duties by Directors, etc. of Subsidiaries of the Company

- The Company has established "Affiliated Company Management Regulations" not only for business management but also to maintain close cooperation and information sharing with our subsidiaries, and clarify policies and standards of conduct for all officers and employees of the Group by fully sharing the Group’s corporate philosophy.

-

4) System to ensure that the execution of duties by Directors and employees of our subsidiaries conforms to laws and regulations and the Articles of Incorporation

- The Company's Management Administration Department is responsible for the management of the subsidiaries, reports to the Company on the status of business execution of the subsidiaries, and provides appropriate guidance if there are any issues that should be improved. Further, the Company's Internal Control Office conducts internal audits based on related regulations and promptly reports the results to the President and Representative Director.

(6) System to ensure that audits by the Audit and Supervisory Committee are conducted effectively

-

1) Matters related to employees who are appointed by the Audit and Supervisory Committee to assist in their duties, related to the independence of such employees from the Board of Directors, and related to ensuring the effectiveness of instructions

- When the Audit and Supervisory Committee requests the appointment of an employee to assist their duties, we promptly respond to ensure that the duties of the Audit and Supervisory Committee are performed appropriately.

- When an employee is appointed to assist the duties of the Audit and Supervisory Committee, the employee is assigned to the duties under the direction of the Audit and Supervisory Committee, and we respect the opinions of the Audit and Supervisory Committee with respect to the appointment, transfer, personnel evaluations, rewards and punishments of the employee.

-

2) System for reporting by Directors and employees of the Group and other reporting to the Audit and Supervisory Committee

- If officers and employees of the Group discover violations of laws and regulations or the Articles of Incorporation related to the execution of duties, fraudulent facts, or any facts that may cause significant damage to the Group, they promptly report to the Audit and Supervisory Committee. The Company's Internal Control Office reports the status of internal audits to the Audit and Supervisory Committee. Further, any whistle-blowing is promptly reported to the Audit and Supervisory Committee.

-

3) System for reporting by Directors, auditors and employees or a person who receives a report from these persons to the Audit and Supervisory Committee

- In the event that officers and employees or a person who receives a report from these persons identify material issues that may have a significant impact on the execution of duties and management, they promptly and appropriately report to the Audit and Supervisory Committee. However, this does not apply to whistleblowing made in accordance with the whistleblowing regulations if consent for disclosure to anyone other than the whistleblowing contact person is given.

-

4) System to ensure that persons who report to the Audit and Supervisory Committee are not treated unfavorably as a result of such reporting.

- The Company protects the person who reported to the Audit and Supervisory Committee by prohibiting any unfavorable treatment of such employee.

-

5) Matters related to policies related to the procedure for advance payment or reimbursement of expenses and the processing of other expenses or debts arising from the performance of duties by Audit and Supervisory Committee members

- In the event that an Audit and Supervisory Committee member requests advance payment, etc. of expenses for the execution of duties, the Company promptly settles such expenses, except in cases where such request is clearly recognized not necessary for the execution of duties.

-

6) Other systems to ensure that audits by the Audit and Supervisory Committee are conducted effectively

- In principle, the Audit and Supervisory Committee comprised of outside Directors serves to increase transparency for stakeholders. We invite persons with business experiences, experts and qualified persons such as CPA as members of the Audit and Supervisory Committee to increase the effectiveness of the audits.

- The Audit and Supervisory Committee holds meetings from time to time to discuss and exchange opinions with the President and Representative Director on important issues, etc., and also regularly exchanges information with the Accounting Auditor and the directors of the Company's subsidiaries.

(7) System to ensure the reliability of financial reporting

- The Company established the “Basic Policy for Evaluation of Internal Control over Financial Reporting” in order to ensure the reliability of financial reporting, and implemented an internal control system related to financial reporting.

(8) System for eliminating anti-social forces

- Our basic policy is not to have any relationship with anti-social forces and to refuse unreasonable demands. If it turns out that a business partner is an individual, company or organization involved in such, we terminate any transactions.

- Build a cooperative system in collaboration with corporate lawyers and external specialized agencies.

Basic approach to eliminating anti-social forces

With regard to anti-social forces and groups that pose a threat to the order and safety of the society, the Group does not allow their involvement and take a resolute attitude not to yield to unreasonable demands.

CURVES Group: Five Management Guidelines

The Curves Group's "Five Management Guidelines" are as follows.